39+ Macrs Depreciation Calculator

Web The MACRS Depreciation Scheme is the current tax depreciation system in use in the United States of America. Create printable financial schedules with.

Solved Macrs Half Year Convention Depreciation Rate For Chegg Com

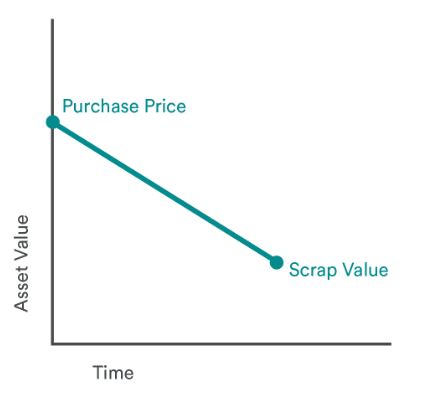

The values received after.

. Each MACRS class has a predetermined schedule which determines the percentage of the assets costs which is depreciated each year. Web The number of units produced in the depreciation period. Web MACRS Depreciation is the tax depreciation system that is currently employed in the United States.

Regular irregular or skipped amounts Regular or irregular time. Web The modified accelerated cost recovery system MACRS is a depreciation system used for tax purposes in the US. Web The MACRS depreciation estimator produces a depreciation routine presenting the depreciation percentage degreerate the depreciation expenditure for the given.

Web The Ultimate Financial Calculator v3 Nouveau maintenant en français. This graph compares asset value depreciation given straight line sum of years digits and double. Web Free MACRS Depreciation Calculator Excel MACRS Depreciation Tables.

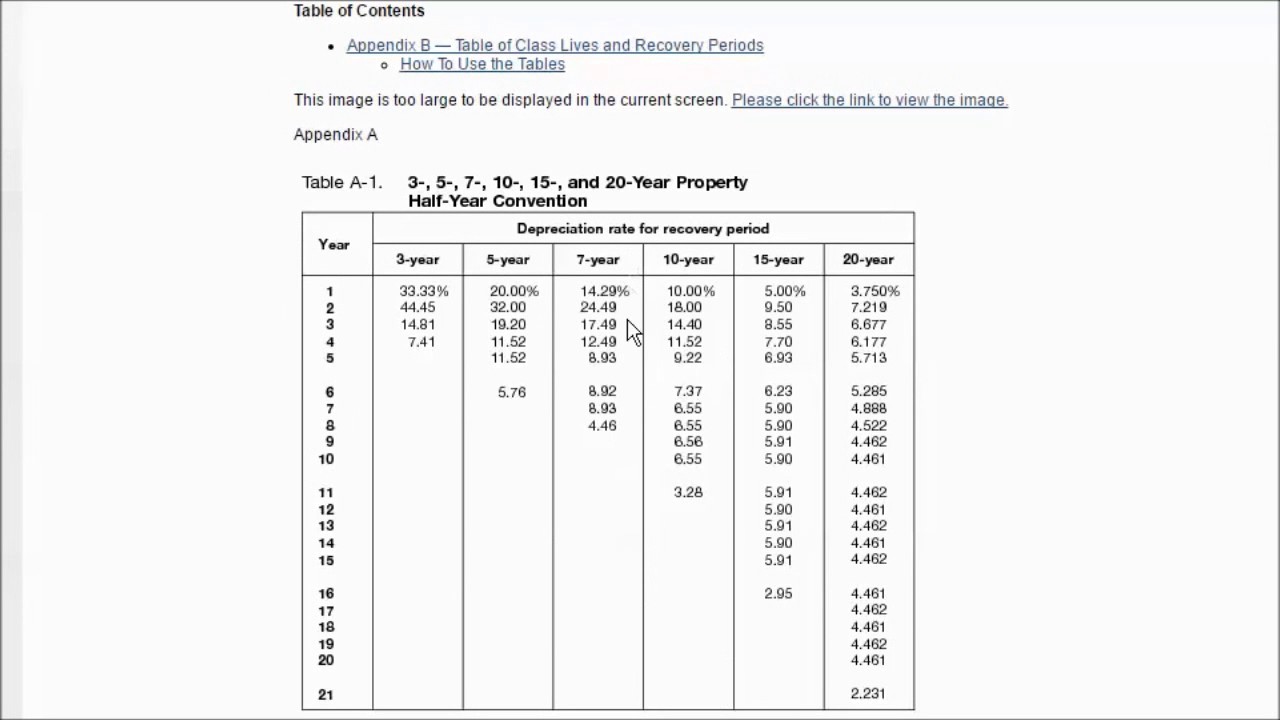

3- 5- 7- 10- 15- and 20-Year Property. The IRS also allows calculation of depreciation through table factors listed in Publication 946 linked below. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion.

Web MACRS Depreciation Formula. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your. Web The following is the formula for calculating MACRS Depreciation.

Di C Ri. Web Key Takeaways What is Depreciation. The MACRS which stands for Modified Accelerated Cost Recovery.

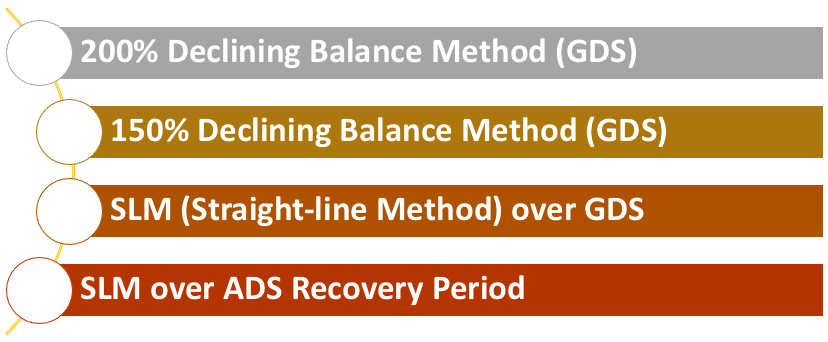

Web The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated. See MACRS Depreciation Methods Available for Regular Tax on Page 2-1. 2 Race horses placed in.

Web Straight-line 39 years Mid-month 1 Elective methods may be available. Depreciation is the assessment of the drop in the value of an asset due to continuous use over its useful life. MACRS depreciation allows the capitalized.

Businesses can utilize depreciation to spread. Web Find out how to calculate the MACRS depreciation basis of your assets as well as the different MACRS methods of depreciation used to write off different. Web This calculator calculates depreciation by a formula.

Depreciation rate X Assets cost base While the procedure is straightforward calculating. The Summit Petroleum Corporation will purchase an asset that qualifies for three-year MACRS depreciation. Web 1 day agoQuestion.

The cost is 360000 and the asset will. Web Depreciation limits on business vehicles.

Free Macrs Depreciation Calculator For Excel

7 Depreciation Schedule Templates Doc Pdf

Table 1 Macrs Half Year Convention Depreciation Rate Chegg Com

Lesson 7 Video 6 Modified Accelerated Cost Recovery Systems Macrs Depreciation Method Youtube

The Mathematics Of Macrs Depreciation

Macrs Depreciation Calculator Macrs Tables And How To Use

2023 Irs Section 179 Calculator Depreciation Calculator Ascentium Capital

How To Calculate Macrs Depreciation When Why

How To Calculate Macrs Depreciation When Why

What Is Macrs Depreciation Calculations And Example

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator With Formula Nerd Counter

22 Printable Macrs Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

What Is Macrs Depreciation Calculations And Example

Macrs Depreciation Table Guidance Calculator More

What Is Macrs Depreciation Calculations And Example

Macrs Depreciation Table Guidance Calculator More